The times of great change continue to drive and accelerate technology like never before. As more customers lean towards accessibility and convenience, industries like fintech are searching for new ways to ensure their products stand out.

FinTech apps have reached new heights as more users embrace mobile technology. In recent years, mobile transactions have reached an all-time high. According to studies, the worldwide growth of finance apps is on the verge with digital payments becoming more prevalent and the fintech market expected to reach $700 billion by 2030.

Mobile applications have altered customer experience. And in the next few years, it will be critical to consider adaptable features that will gain high-value customers and keep them coming back.

While multipurpose fintech apps may offer a wide list of payment options in different currencies, expense tracking, and a handful of investment tools, the truth is that not every fintech app needs to include those same features. At the same time, there are certain characteristics that every quality fintech app should have, regardless of industry vertical, size, target audience, or regions they operate.

How do you drive engagement and build a successful fintech app?

You need to invest in the most promising features. It’s also crucial to strike a balance between innovation and quality service.

Users favor modern, flexible, and scalable mobile applications, especially for their banking needs. Rather than an immersive experience, they want an easily understandable, intuitive interface that helps them finish their tasks and go ahead with their daily activities.

Must-have fintech app features that can add value to your product while also boosting usability for the customer

1. Biometric authentication

Multi-factor authentication with safe sign-in choices and current technologies is a must-have feature for every fintech app in 2023.

Most consumers do believe biometrics is a more secure way to access their financial information than passwords and PINs. Biometric technology uses a person's unique characteristics (facial, voice, or fingerprints) for recognition. It can be used instead of a password to log into an app or access certain functions. There are APIs you can use for biometric authentication, but both iOS and Android allow app developers to use their device's in-built biometric authenticators. You can enable Touch ID and/or Face ID for iOS users and use the Biometric Authenticators for Android users.

Biometrics can improve security as it's harder to replicate a biometric component than to replicate/hack a password. Furthermore, it protects users from losing access to their financial app because of a forgotten/error password.

This higher level of security is felt by consumers.

2. Personalized budgeting

Consumers come with different income levels, lifestyles, and budgets, which is why personalization is everything in the fintech world.

According to a recent report by MX, 70% of customers expect their providers to send them personalized notifications, while 63% also expressed the need for proactive services in financial management.

Simply put, ensuring that your users find personalized digital budgeting services in your mobile app is vital.

This could mean things like:

- Helping and motivating your users to save every week (for example, for a car)

- Nitificate them when they spend too much on luxury and entertainment

- Setting automatic payments for utilities, rent, and credit card bills

- Performing deep and useful insights into their spending habits

Financial management remains a pain point for most users worldwide. By making your customers know that you care about their spending and better habits, they’ll see you as a valuable part of their lives. Thus, you encourage both engagement and loyalty.

3. Multi-user collaboration

There are numerous scenarios where people need to collaborate with someone else on a financial transaction. Enabling your users to send and sign contracts from your app is a game changer. By enabling multi-user collaboration, two or more parties can use the same app to work through deals, tasks, and transactions instead of needing two separate apps. People love saving time and space on their digital devices. Furthermore, both parties can work together more efficiently and effectively.

With HelloSign or another e-signature API, you can enable users to send and sign contracts for real estate transactions, insurance quotes, investment deals, personal loans, and much more without switching apps.

4. Live chat for support

Most customers hate long calls but appreciate fast support service. Not only is live chat convenient for your customers, but it can also help boost revenue for companies that offer it.

Chat functions allow customers to get help quickly without having to wait for a response through email or phone. Customers prefer using chat for almost anything: from asking questions and getting technical advice to reporting a mistake and sending information. A reliable chat function is the foundation of a great customer experience.

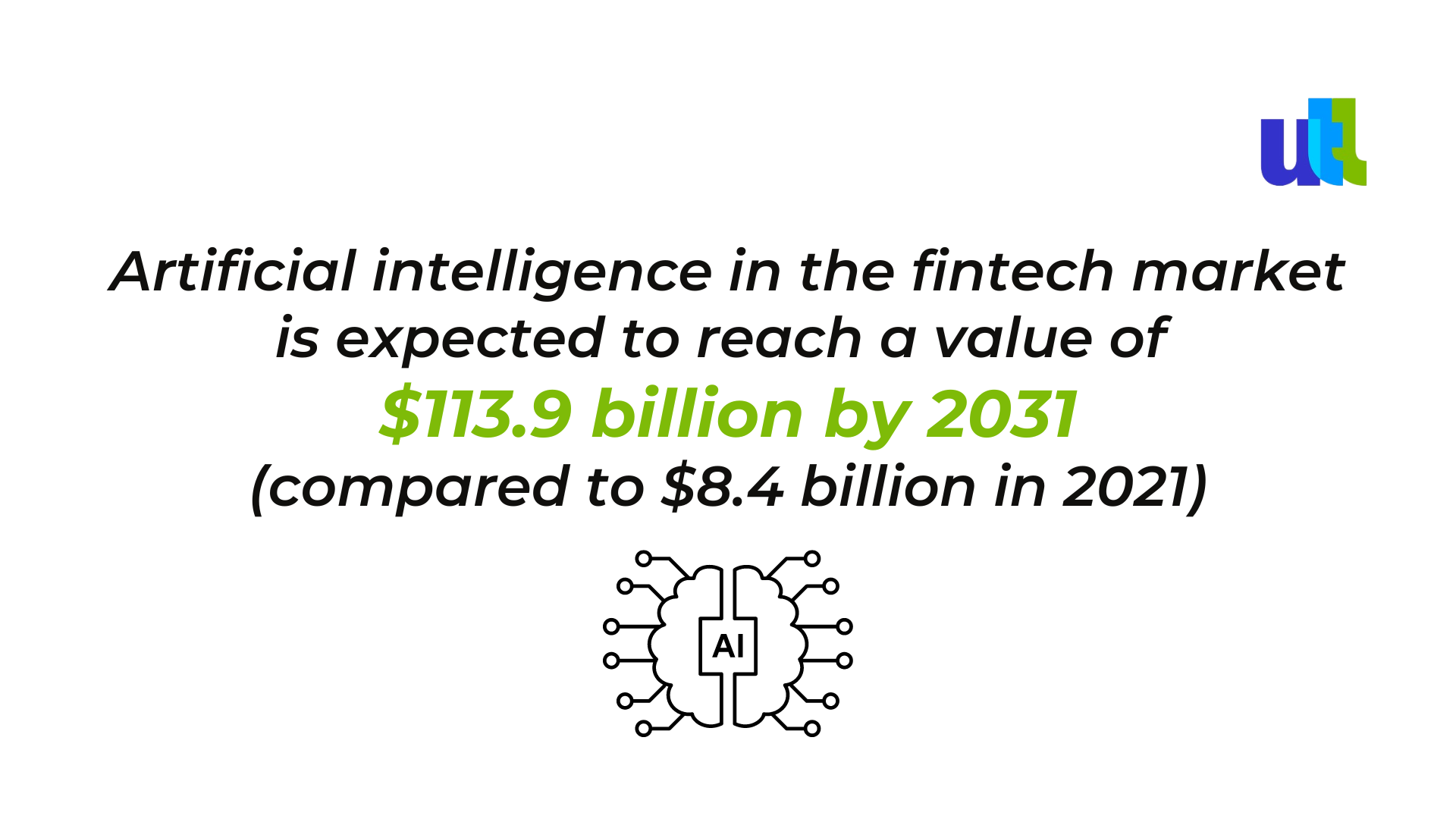

5. AI for analytics and data visualization

Charts, graphs, and other data visualization tools provide users with better insights that help them understand their finances and make better decisions about their money. You can also use AI to analyze current stock trends and make recommendations based on the investment patterns of each user.

Adding an AI component to your app increases its value.

Prioritize the most impactful features

Fintech apps expand what’s possible for personal finance, business finance, debt repayment, money transfer capabilities, and other financial activities. A well-designed fintech app that includes the aforementioned elements will help you attract new clients, stay ahead of the competition, and provide a much more impressive customer experience. Prioritize the ones that will be most impactful in your particular case.

Ready to expand your mobile apps’ financial features? Enrich your existing software or grow your app by contacting Utah Tech Labs (link)

For free consultation about fintech app click here.

----------------------------------------------------------------------------------------------

View the full presentation:

WRITTEN BY

Sofia Kutko

2023-05-31